History of Autoclaved Aerated Concrete: The short story of a long-lasting building material

Autoclaved Aerated Concrete (AAC) is a popular building material that draws its roots from the early 20th century. Throughout its existence, AAC has gained a considerable share in international construction markets and today maintains its reputation of the building material of the future.

This review presents the background on AAC discovery, early commercial development and eventual international success. Different AAC manufacturing technologies are hereby described and how competition contributed to ways of making AAC over the years. An overview of the latest AAC developments due to continued innovation will conclude with an outlook on the AAC industry landscape.

Early History of AAC

AAC as a building material has been industrially produced since the beginning of the 20th century. AAC stands for Autoclaved Aerated Concrete, alternatively known as Aerated Cellular Concrete (ACC) or Autoclaved Lightweight Concrete (ALC). The early history of AAC is based on a series of process patents.

In 1880, a German researcher, Michaelis was granted a patent on his steam curing processes. Czech Hoffman successfully tested and patented the method of “aerating” the concrete by carbon dioxide in 1889. Americans Aylsworth and Dyer used aluminium powder and calcium hydroxide to attain porous cementitious mixture for which they also received a patent in 1914. Swede Axel Eriksson made a serious next step towards developing modern AAC, when in 1920, he patented the methods of making an aerated mix of limestone and ground slate; so-called the “lime formula”.

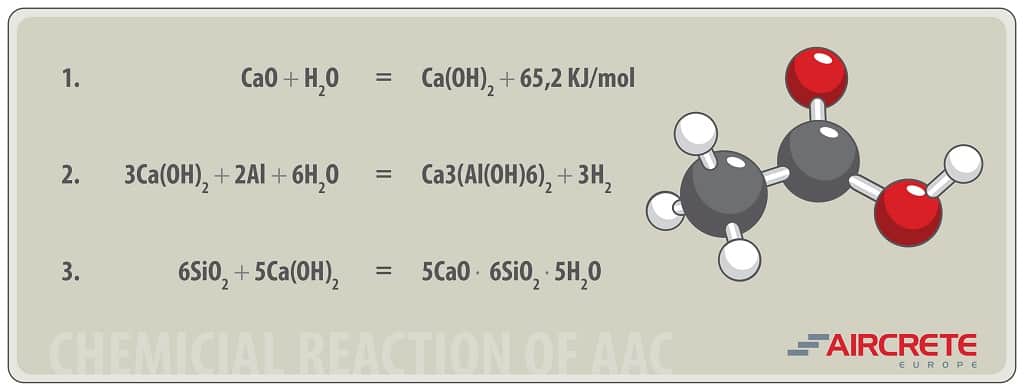

Chemistry

The combination of cement, lime, gypsum (anhydrite), finely ground sand and most importantly aluminium powder causes the mixture to expand considerably. From the beginning to the end the simplified chemical reactions are shown in the above figure, which is the final Tobermorite or Hydrated Calcium Silicate C5S6H5.

The Breakthrough

The real breakthrough in the masonry industry came in 1923 when the same architect Axel Eriksson discovered that this moist foamed mass can easily handle pressurized steam curing process, also known as autoclaving. While applying for a patent, two crucial conclusions were drawn:

1. the material hardened fast thanks to the autoclaving process

2. shrinkage was almost absent after steam curing compared to the normal air curing.

Additionally, it was also discovered that alternative materials, such as pulverized ash, could be used instead of lime/cement, allowing to economize on the expensive raw material binder.

Start of Commercial Manufacturing of AAC

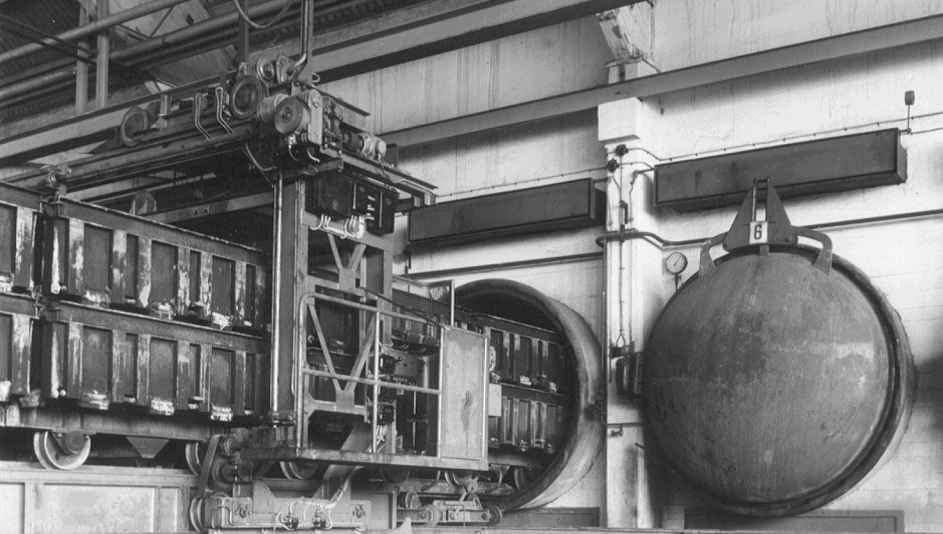

Eriksson’s success immediately attracted a much-needed commercial interest and in 1929 the first large scale manufacturing facility of these artificially-made crystalized stone blocks was launched in a factory named “Yxhults Stenhuggeri Aktibolag” in Sweden under the name Yxhult (Fig. 2 & 3). In 1940, the Yxhult name was changed to Ytong as this name was easier to pronounce.

Fig. 2: First large scale manufacturing started in 1929 (Picture source: Y som i Yxhult by Linda Gustafsson)

Fig. 3: Pressurized steam curing process in autoclaves (Picture source: Y som i Yxhult by Linda Gustafsson)

In 1932, the factory Carlsro Kalkbruk Skovde started with AAC block production and the product acquired the brand name Durox. An important competitor arose in 1934, which started to manufacture AAC blocks under the brand name Siporit and renamed as Siporex as of 1937. Siporex was also the first to introduce the AAC reinforced elements in 1935, namely roof, floor panels and lintels.

Good structural properties of the newly created AAC material soon spread all over Western Europe, with more than six plants only in Sweden alone.

Different Technologies – International Success of AAC

AAC manufacturing went international in 1937 with the introduction of technology licensing and know-how transfer. After World War II, there existed only a few leading AAC technology suppliers: Siporex and Ytong (both belonging to the Swedes), Durox (bought by the Dutch) and Hebel (German). Throughout the 20th century, all of them successfully sold AAC technology licenses around the world, while at the same time annual conventions contributed to further developments in AAC production, product quality and its applications.

Among different manufacturing technologies, production of AAC blocks became associated with Ytong (tilt-cake system), while production of both AAC blocks and reinforced elements was led by Durox, Siporex and later on, Hebel with flat-cake systems.

Competition and Growth of the AAC Market

Germany, the United Kingdom, Sweden, Denmark and the Netherlands established themselves as the main AAC hubs after WWII, albeit the fact that countries used different technologies to produce similar products. Following the triumph of AAC material on an international arena, competition grew stronger between the parties in that relatively small market, often ending up in a battle of patents. Slowly in the 1980s, the influence of Swedes was diminished due to the suffering domestic market. As a result, Siporex activities were reduced to a minimum level and no new plants were built since the 1990s.

Additionally, during the 1980s, Germans took over and improved on the know-how of Ytong from the Swedes. Despite fierce competition, multiple plants were realized in Asia, Middle East and Eastern Europe, based on all four different technologies. At the beginning of the 1990s, the first AAC plant based on a tilt-cake technology (Ytong) was supplied to China. From that point onwards, technology outflow became widespread and as of 2014, there are more than 3,000 AAC production facilities worldwide with an estimated production capacity of 450 million m3 per year of non-reinforced blocks. Mass production of blocks is also popular in Central and Eastern Europe and India while Japanese, Korean, Australian and Western European markets are focusing more and more on reinforced panels and high precision blocks.

Reinforced AAC Elements

Shortly after the first AAC block plant emerged in Sweden in 1929, structural reinforced elements followed. Siporex posed a strong competition to Eriksson’s AAC process technology when the first reinforced roof and floor panels were successfully manufactured in Sweden, with a so-called “cement formula”. It used mainly cement instead of lime as a binder, which improved the process properties as well as structural load-bearing characteristics. The main goal of the Siporex products was to design a complete building system using only AAC.

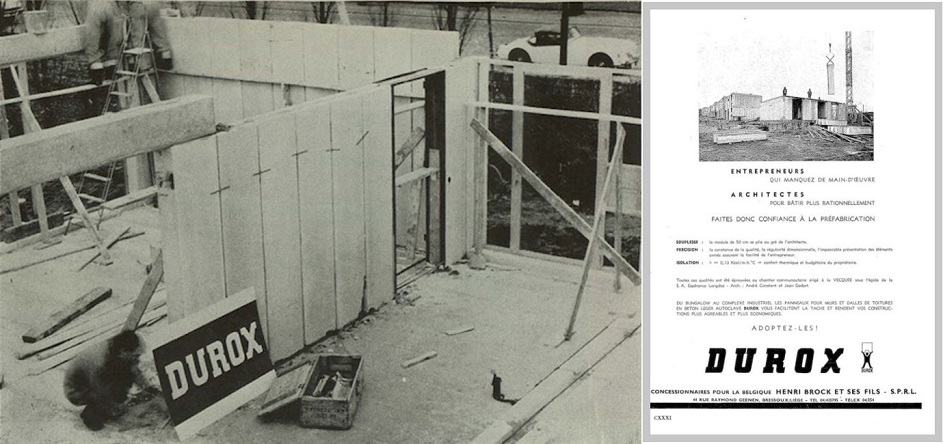

A decade later, Hebel technology evolved in the mid-1940s under the patronage of German engineer Josef Hebel. After studying the plant in the Baltics during WWII, Josef Basel based his production technology on Siporex and managed to bring remarkable improvements to the AAC production technology, especially to the reinforced products. Given the disappearance of Siporex from the market, Durox and Hebel technologies became leaders in supplying the reinforced AAC elements due to their more suitable and favourable cutting and curing technique (Fig. 4).

Fig. 4: Building with (Durox) AAC panels in 1960s (Picture source: Post-war Building Materials)

In Eastern and Western Europe, many AAC plants successfully supply both AAC blocks and AAC panels. Japan until today, remains a 100% reinforced elements market (Fig. 5). Since 2002, reinforced element production was further perfected by the Dutch and nowadays Aircrete Europe’s technology allows manufacturing complete prefab AAC building solutions.

Fig. 5: Reinforced AAC panels allow fast and economic construction

Taking into consideration fast, economic and structural building with AAC panels, many countries today are looking for ways to introduce complete AAC building solutions in their local construction markets.

Mergers & Acquisitions in the Global AAC Landscape

Mergers and acquisitions wave of the 1990s has had a crucial impact on the world of AAC as we know it today. In the period between the early 1990s and early 2000s, ownership of technologies, plants and brand names became disoriented. Plants, patents, technologies and patents of Durox, Ytong and Hebel ended up under one roof and named Xella. At one point, Hebel and Durox products were produced under the brand name Ytong, as all three brand names were unified under the name Ytong. In 2001, a range of factories was closed under the premise of overcapacity.

Many AAC technology specialists lost their jobs. Hebel took the biggest hit as their main base in Emmering, Germany was closed, and some Hebel facilities were liquidated, stating that production costs became too high. The market of architects, builders and especially the end consumers could not understand the disappearance of the well-known brands.

Following this, the brand “Hebel” was reinstated as a brand for the reinforced products, while Ytong remained a brand for blocks. Furthermore, not a single Durox plant was closed throughout AAC’s history and AAC is produced until now in the remaining plants as well as the original Durox based plants. The period was an exodus of know-how in the AAC world and many licensees had to find their own way in the world of AAC.

AAC Machine Builders

During the aforementioned period, market forces changed considerably shifting the focus away from technology and processes to machines and pricing. The machine builders, mainly from Europe and later China, entered the open space in the market. Ytong technology and its various tilt-cake derivations were picked up by machine-building companies and sold as “own technology” AAC equipment. The focus of the industry went from technology supply and assistance

to machine supply and after-sales.

Autoclaved aerated concrete world market became fragmented as knowledge sharing about production technology, product application and latest developments was not promoted anymore. Machine builders – generally – do not own AAC production facilities and therefore rely only on their customers when it comes to AAC product, application, chemical processes, etc.

Additionally, the financial participation of technology suppliers in their own factories was not uncommon in the past. Hence, the gap between the architects, contractors, factories and machine builders is wider today than it used to be, forcing every AAC producer to solve the same industry issues on their own.

AAC Products Today

The technology of AAC production has developed significantly over the last decades. Production of ordinary non-reinforced AAC blocks is not linked to any exclusive know-how anymore and as a result, AAC blocks became a commodity in many markets. Manufacturing light and heavy reinforced AAC elements is still a big challenge for most of the producers in the world, primarily with tilt-cake technologies. Nevertheless, in time, the physical properties of AAC material improved and applications became more universal from the construction point of view. Today, AAC is a structural solid building material, an excellent thermal insulator, a good sound absorber and an attractive decoration material.

Certain technology professionals are able to produce products with a density range from 300-800 kg/m3. Nowadays, lambda values of 0.08 (thermal conductivity) at a density of 300 kg/m3 is not an exception anymore. Additionally, compliance with strict EU standards (EN 771-4 and EN 772-16) results in high-precision products (tolerances of <1 mm for blocks and <3 mm for panels) which can be finished on-site with a thin bed mortar instead of a thick layer of standard mortar, allowing to economize on the total cost of construction.

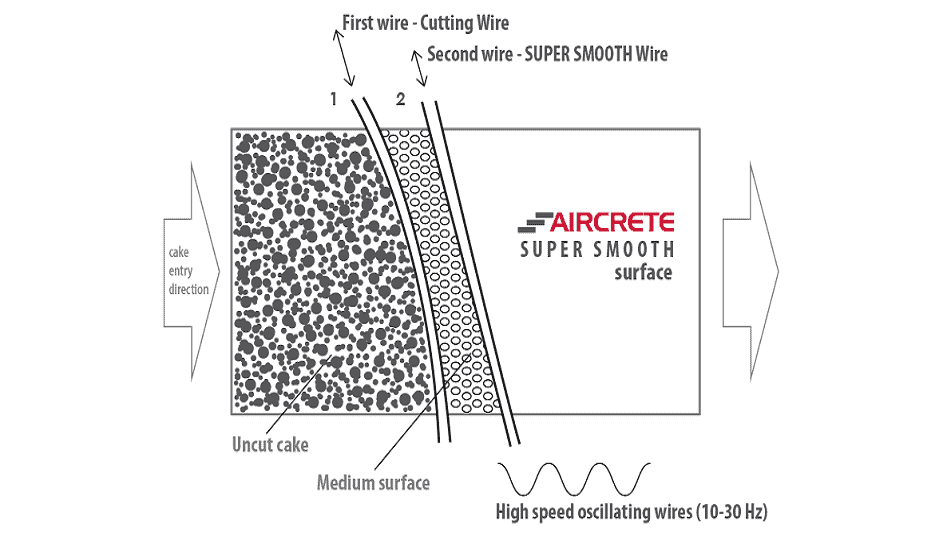

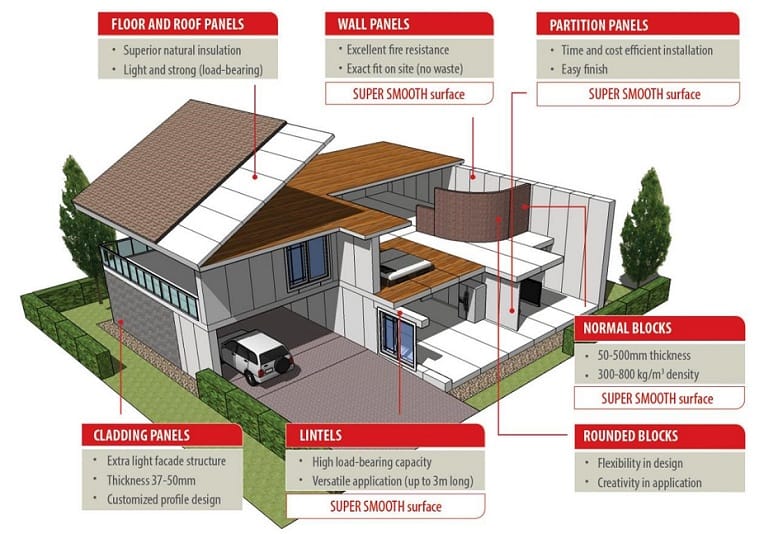

The production of Ultra-Light AAC blocks with a lambda value of 0.045 and lower density of 145 kg/m3 is already a foothold in the European AAC market. The presence of smooth product surfaces, developed in 1987 on a Durox line in the Netherlands, has changed the markets considerably. Aircrete Europe has further improved that technology by introducing so-called Super Smooth (Fig. 6) surfaces to AAC products thanks to its innovative flat-cake technology with a high-speed cutting frame. This system uses a double wired cutting technology which produces product surface with closed pores. As a result, fast and cost-effective finishing is possible, such as direct application of paint or wallpaper.

Fig 6: Double wired cutting technology for Super Smooth cutting line by Aircrete Europe

AAC also offers a solution to the safe buildings in seismically active zones, such as Japan, where a rocking AAC panel design offers buildings protection up to 8 on a Richter’s scale. Another grand AAC development is AAC panels with increased sound absorption properties, named Shizukalite boards, a solution which offers an extra comfort of soundproofing for any type of sound-sensitive environments. In contrary to conventional AAC independent pore structure, these AAC panels have continuous open pore structures providing an opportunity for ideal acoustic absorption next to roads, HVACs, offices, etc.

Application of AAC panels as firewall solutions, both internal and external (Fig. 7), further supports the universal building material image of AAC, as it can easily withstand up to 5-6 hours of direct fire exposure. With these modern products, AAC as a highly insulating and ecological material, can contribute to the largely popular “green-housing” tendencies. Ultimately, with a focus on energy efficiency, designing homes without energy appliances, which is called “passive house” has become a reality.

Fig 7: AAC panels used horizontally as external walls of an industrial building

The Future of AAC

AAC market development went through a major revolution since the 1990s. With the large increase in the absolute number of AAC manufacturing facilities, producers worldwide are striving to improve the balance between manufacturing cost and physical material properties, with a focus on thermally efficient building.

International “green” policies and strict building regulations are putting pressure on AAC producers demanding more energy-efficient materials (low-density blocks and panels), better quality products (high product accuracy, surface quality) and a wider range of product application (residential, commercial and industrial). Beyond the existing AAC commodity market of blocks, there is a growing worldwide demand for integrated building solutions (Fig. 8).

Fig. 9: All elements for a total building solution in Aircrete Building System are made in a single factory with a one-stop-shop concept

It is well known that building with AAC panels makes it possible to reduce the total cost of ownership for the final consumer. Offering buildings made of solely prefab AAC elements result in a fast, easy construction and no on-site waste.

Inevitably, this forward-looking approach requires investment in high-quality and automated equipment that uses the latest manufacturing technology. Hence, both existing manufacturers of AAC blocks and new investors that are looking to introduce AAC to their market should not limit themselves to low quality and limited range of product output.

Producing a complete AAC solution is the next step towards the market expansion and increasing market share of AAC as a building material. Investments in innovative plant upgrades and new plants with modern AAC technology are essential to staying ahead of the ever-changing construction market.